Latin America is set to become a future leader in the biostimulant market, which encompasses a variety of compounds, such as amino acids, organic acids (humic and fulvic acid), microbials and algae extracts. “We are seeing a market that is clearly growing. In 2020 alone we would be talking about a market valued at US$2.200 million. This growth is accelerating”, says Manel Cevera, managing partner of Dunham Trimmer, a market research company that specializes in biological products and speciality nutrients for the agricultural sector.

The upward tendency responds to a series ofdriversand trends that have favored the biostimulant industry worldwide. Countries that produce fruits and vegetables, such as Peru and Chile, are no exception.

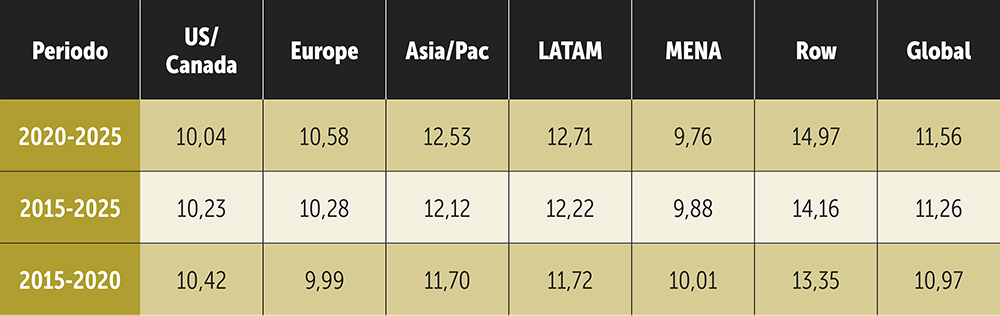

According to Dunham Trimmer projections, the biostimulant market in this region will register growth rates of 12.71% between 2020 and 2025. In the same analysis period, a growth of 12.53% is expected for the Asia-Pacific region, as well as 10.58% for Europe and 10.04% for the United States and Canada. The expert notes that, although the main region for the biostimulant market is Europe, the "growth factors have spread to all types of regions and crops".

Table 1. Estimated growth of the biostimulant market by region (in %).

Table 1. Estimated growth of the biostimulant market by region (in %).

According to the company, there are two large groups that make up the biostimulant market: protein hydrolyzed amino acids and algae extracts. Together they have a market share of 61.1%, and it is expected that this will increase one percentage point by 2025. They are followed by humic and fulvic acids, with a share of 28.3%. The market research company estimates that by 2025 this will decrease slightly and stand at 27.2%. “In the ”others” category, I would include some inorganic-based products, a few plant extracts and especially some microbial products (in the study published to date, these microbials mainly include mycorrhizae). Microbial products would make up around 70% of this category”, adds Cevera.

Brazil maintains the leadership in the region

Although the biostimulant market in Latin America has been gaining more prominence in countries such as Peru and Chile, Brazil is and will continue to be the main market in the region. As said by Cevera, Brazil is the world’s best example of the growth potential of biostimulant products in more extensive crops. “I am mainly speaking about soybean, but we could expand it to other extensive crops. This is due to the fact that soybean cultivation in Brazil is more intensive than in other parts of the world, starting with the number of times that fungicide products must be applied. On the one hand, the fact that they must enter the crop field more often and invest in moreinputsmeans that there is a greater willingness to add the cost of biostimulants. On the other hand, this more intensive type of cultivation creates a higher level of stress in the plant, which is another factor that helps incorporate this type of product”, explains the specialist.

"Ensuring the production of high-value crops guarantees the return on investment that makes it worthwhile for the farmer to incorporate biostimulant tools"

Manel Cevera, managing partner of Dunham Trimmer

Together with Brazil, Mexico presents high growth rates. "Both are paradigmatic markets, in the sense that they present high growth rates, and are historical markets in the use, management and development of this type of product", he highlights. In the case of Mexico, the specialist adds that we must not forget that one of the reasons that the use of biostimulants has grown has been that both the local and North American markets have high purchasing power. This means that there are consumers willing to pay for vegetables that are out of season and that have certain qualitative aspects, such as larger size, better color and higher sugar content. "Ensuring the production of high-value crops guarantees the return on investment that makes it worthwhile for the farmer to incorporate biostimulant tools," he maintains.

IN A HIGH-VALUE AGRICULTURE. "Ensuring the production of high-value crops guarantees the return on the investment made by the farmer when incorporating biostimulant tools," he maintains.

IN A HIGH-VALUE AGRICULTURE. "Ensuring the production of high-value crops guarantees the return on the investment made by the farmer when incorporating biostimulant tools," he maintains.

Cevera explains that in the case of Peru and Chile, biostimulants are beginning to be used more intensively given these countries’ tradition in fruit and vegetable exportation. "Peru is expected to take the lead over Chile as a large market for biostimulants" Cevera anticipates. On the other hand, countries such as Colombia and Ecuador are also emerging as potential markets. "In Ecuador, some crops such as bananas are markets that are already accustomed to the use of biostimulants," he says.

As for Central America, he emphasizes that it is a region "where the biological issue is important, the level of implementation is growing", since there are crops such as bananas, pineapples and coffee that respond very well to the use of biostimulants. He even considers that Cuba should be on the radar of the biostimulant industry. “We’d be making a mistake if we do not consider Cuba as an important market for biostimulants. For certain sectors it has a lot of potential. The niches are huge,” he says. Guatemala is also a potential market, because it exports many kinds of vegetables and has a high use of biological products.

Drivers of the growing industry

The need of agricultural producers to increase plants’ resistance to abiotic stress and to opt for an intensive production system, together with the greater willingness of consumers to pay for high quality crops, have become the main factors that are driving the growth of the biostimulant market. "The producer has to take preventive action and bring his/her crop to a metabolic level of resistance to stress, taking into account crop management as well as abiotic factors," says Cevera. Also, he argues that there are more consumers willing to pay for fruits with higher qualitative aspects, such as better size, homogeneity, sugar content, flavor and fruit formation. "If there is a market that is willing to pay, there will be a farmer willing to invest," he stresses.

The implementation of intensive production systems is also gaining more relevance. This is because of the need to increase agricultural productivity, given the tendency of higher population growth. UN estimates suggest that the world population will rise to around 9.700 million by 2050, from its current level at 7.700 million. At the same time, there is a need to have a more efficient and sustainable agricultural production in order to face the scarcity of natural resources and climate change. “These two terms, intensity and sustainability, are apparently contradictory. However, precisely this contradiction makes biostimulants one of the few tools that really helps fit these two terms together”, he argues.

FOLIAR APPLICATION. Foliar treatment of biostimulants in zucchini crops.

FOLIAR APPLICATION. Foliar treatment of biostimulants in zucchini crops.

On the other hand, the expert maintains that in recent years policies in favor of the biostimulant market have been enacted. As a reference he cites the European Union, which ultimately aims to achieve climate neutrality by 2050. In this framework, the EU Commission presented the 'Farm to Fork' strategy that advocates more sustainable production and consumption of food. This initiative establishes ambitious objectives in the use of pesticides and fertilizers, the sale of antimicrobials or the increase of areas dedicated to organic crops, very much in line with the 2030 Biodiversity Strategy.

This is because the strategy deployed by the EU seeks to reduce the total use of chemical pesticides by 50% and promote the use of biological products, as well as reduce nutrient losses by 50%, reduce the use of fertilizers by at least 20%, and ensure that at least 25% of agricultural land in the EU has ecological certification.

The expert also highlights that in Latin America Brazil recently launched its new National Bioinput Policy, which promotes the use of this type of product in all crops nationwide. "This is a great example of promotion and active policy for the use of bio-inputs," he says. These policies seek to support the creation of biological product factories and promote actions aimed at stimulating the production, processing, distribution, marketing and consumption of bio-inputs. Today in Brazil more than 2 million hectares already fight insects with bioinsecticides and more than 40 million hectares use growth promoters and bacteria. “Other countries are also doing this, like India and China,” he remarks.

Biofertilizantes, otro nicho en desarrollo

Given the favorable trends for the development of biological products, the biofertilizer market has also grown. “The most recent data we have is that the figure as of today would be around US$1.3 billion. In 2021 it would reach US$3.5 billion”, the specialist claims. He adds that an important part of this market is made up of inoculants and nitrogen fixers for the cultivation of legumes.

“In the case of the soybean, a series of innovations used in this crop are the main growth driver in this biofertilizer market. For the rest of the legumes, the growth of biofertilizers is more linked to what can actually be grown on the cultivated soil”, highlights the expert. This partially explains why Brazil and Argentina are the main markets for this industry, followed to a lesser extent by Mexico. Paraguay and Bolivia are also projected to be future key countries in the biofertilizer market.

Factores influenciadores

According to the expert, there are a few factors that can have an impact on the biostimulant market. The first has to do with the pressure of achieving a greater differentiation in order to avoid a growing risk of commoditization (banalization). “In my opinion, the companies that will play a leading role are those that are capable of maintaining good market access (focusing their actions on a commercial and marketing level, as has been done almost exclusively until now) while at the same time changing their focus towards research and development and the promotion of strategies based on science and quality”, he affirms.

He adds that it is no coincidence that last year the Syngenta Crop Protection business unit of the Syngenta Group acquired Valagro, a leading company in biological products. This meaning that the strategic acquisition allows Syngenta to develop a global leadership in the biological product business.

A second element that has already had an impact on the industry has to do with the regulatory barriers for these type of products. Solid movements already exist in Europe and, to a lesser degree, in North America, aimed at achieving a more standardized and homogeneous regulatory framework that will surely require further validation and verification studies, while at the same time open the possibility for stricter control of those companies that do not comply with said regulatory framework. This creates a growing pressure on companies that wish to have market leadership to increase the degree of tests and contrasted studies.

The greater willingness shown by consumers to buy high-quality crops, that at the same time respect the environment, will continue to be one of the main drivers of growth in the biostimulant market in the future. In order to take advantage of these fair winds, investment in research and development will be important, as well as the consolidation of strategic markets to generate greater synergies.