10/Mar/2022

#03

SUBSCRIBE TO OUR NEWSLETTER

Suscríbete a nuestro newsletter

Last issue articles

- Biome: the space gaining protagonism in biological strategies for crops

- The export dynamics driving the Mexican biologicals market

- New model developed to evaluate effects of two or more biostimulants combined in a single crop

- Dr. Wagner Bettiol and the biocontrol market in Brazil

- Las propiedades que hacen del Trichoderma un socio clave en la búsqueda de mejores desempeños en los cultivos

- Changes in the new regulation on fertilizers and biostimulants in Chile

- Innovak Global, the expansion of root specialists

Market movers

- Renewable-based nitrogen fertilizer firm raises US$ 20 million in investment round

- Bayer and Ginkgo Bioworks close agreement to strengthen open innovation platform for agricultural biologics

- Argentinean firm Puna Bio: Millions raised to study superbacteria for agricultural use

- Corteva Agriscience signed an agreement to acquire leading biologics company Symborg

- Brazilian study uncovers ants' potential in crop protection

- Huber acquires specialty plant nutrition producer Biolchim

- UPL announces agreement to distribute bioprotector based on orange oil

- ICL and Lavie Bio start strategic collaboration to develop new biostimulants

- Hortitool and Green Smile to organize the Morocco Berry Conference 2022

Bioceres: A biological march that goes at full speed

The Argentine firm has achieved unprecedented increases in its revenues, as it concentrates its efforts on reducing the use of chemicals in crops and promoting bacterial inoculants, fertilizers and stimulants. Its sales almost doubled in the end of 2021, it diversified in the United States and Europe, and its profits jumped by 400%.

F. Aldunate M.

"We're moving at full biological speed," he said, explaining that biologics are pushing the company's global presence and margins.

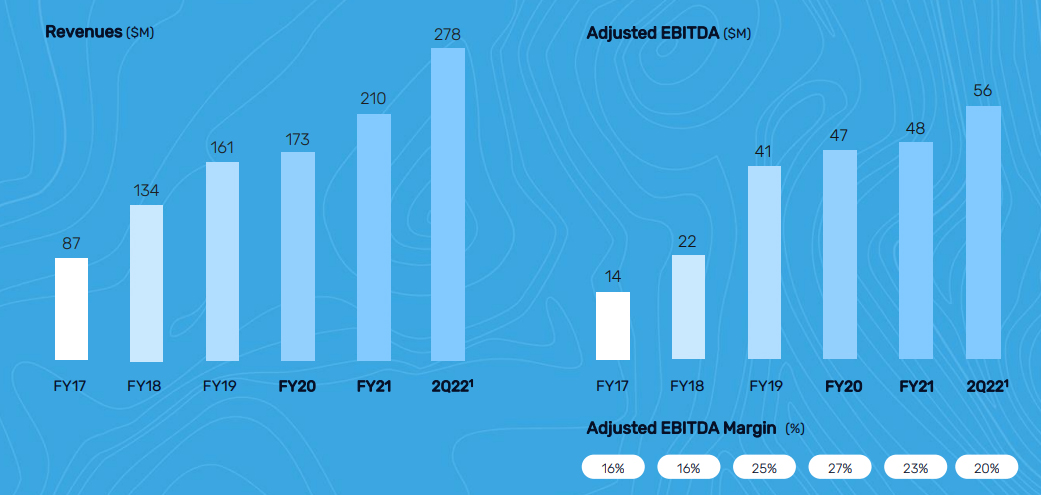

The firm, whose shares have been listed on the New York Stock Exchange since March 2019, recorded sales of US$92.7 million between the beginning of October and the end of December in 2021. This is an unprecedented increase of 90% in its first line. The company had earnings of US$10.8 million during that time frame, a 400% increase in comparison to the same comparable period.

Although the expansion of the company, based next to the Rosario soybean center, was transversal in its three lines of business -seeds and integrated products, crop protection and crop nutrition-, the last two were responsible for the skyrocketing figures: sales of control products jumped 74.5% to US$47.3 million in the quarter, while nutrition jumped 218.5% to US$29.3 million.

Thus, the company’s annual sales reached US$ 262 million, with an increase of 56% for the 12 months of 2021. An outstanding growth level even in a high-growth segment such as biological inputs for agriculture.

In the conference with analysts, Trucco added that growth was also accompanied by market diversification. “We’re also very proud to report that our combined growth in Europe and North America at 146% year after year makes these important geographies at least 10% of our global revenues. A huge step forward in our international diversification strategy” said Trucco. “Biologicals are our most international product”.

EXTERNAL SCIENCE

The company’s dynamism takes place despite the fact that it has no basic science laboratory to carry out biological research that would lead to the next biopesticide or biofertilizer. Instead, the firm has preferred to develop a model that takes advantage of the research available in state centers, universities and private institutions that are spread around its country of origin.

"Argentina has a number of high-level biological investigation and academic institutions, which have a good connection with companies," explains a spokesperson of the firm. "We seek beneficial agreements with the scientists who create the technology, and we translate that into a commercial product." He adds that the company’s laboratories are used in later stages of development of the products.

Bioceres also has the product catalog for Rizobacter, the Argentine company which it bought 50% of in 2015 and later increased its participation to 80% in 2019. In 2020, Bioceres had developed its entire catalog of products based on Rhizobacteria, a bacterium associated with roots that can have different effects on plant growth. In the case of biostimulants, the firm has a solution based on Plant Growth Promotion Rhizobacteria (PGPR) which acts by dissolving phosphorus from the soil, and that is marketed for use in wheat, sunflower and soybeans.

In addition, the firm has marketing agreements with Syngenta and with the French De Sangossey and Florimond Desprez. "We introduced their technology in Argentina, they help us get our products to other parts of the world through their distribution channels," he says.

MORE ADVICE, LOWER PRICE

With the growth of 2021, Bioceres took advantage of its position in the extensive crop market, such as soybeans, wheat or corn, in order to grow together with the expansion in hectares dedicated to soybeans in Europe. However, this was not all that happened. In response to inquiries from Biologicals Latam, the firm explains that the increase was also the result of a change in the commercial structure, where the teams for consultative sales were strengthened and prices of biological products were reduced to increase the customer base. "A while ago, our price for biofertilizers was a little higher than that of our competitors, but we decided to go for a more competitive price," the company says.

This consultative sale and price reduction was strongly favored by the rise in the cost of traditional chemical fertilizers. "The price of traditional fertilizers rose a lot and left it at a value equivalent to biologicals, which has made many opt for the biological option," they say in the company. “Although it is a market situation issue, we believe that many farmers will choose the biological option once they perceive its benefits. They will remain with that option once they perceive that they pollute less and that they generate higher yields”.

The growth in sales has been accompanied by increases in profitability, due to the higher margins granted by biological products. "The margin on these products can reach 60%," Federico Trucco told analysts, comparing them with chemical alternatives that are in a margin of 25-35%.

The firm does not publish the business’s percentages that correspond to products of biological or chemical origin, but they point out that the former are the ones that have driven the rapid recent growth.

THE TRACE OF THE SUNFLOWER

Founded in 2001 by a group of farmers seeking to increase their crop yield, Bioceres made a name for itself with the sale of soybean inputs – the company has 24% of the market share for soy inoculants worldwide – and with the development of modified seeds of extensive crops that have high resistance to drought. These are presented under the name of HB4, which is the acronym for the genetic trace that is taken from sunflowers and has allowed them to transfer that property to soybeans and wheat. HB4 soybeans already have marketing authorization in several countries, but wheat is just beginning to emerge, as it is only approved by the Argentine government, which in 2020 became the first country in the world to authorize genetically modified wheat.

Bioceres has not begun marketing this wheat as it is waiting for Brazil – the country that buys 80% of the Argentine production of this cereal – to approve its imports. In November, the South American giant took an important step by allowing the entry of flour made from modified wheat, although not the grain itself. The firm recently hired Brazilian scientist Alexandre García to lead its global seed operation, which added sales of around US$38 million in 2021.

Although the development of the HB4 business is a priority for the company, for now the activity is focused on biocontrol and nutrition, where its biological offer is concentrated and is offered in packages, with complete solutions based on different products.

LESS CHEMICALS

Their focus in recent years, they point out, has been on the commercial development of biological solutions for extensive crops, as well as products that reduce the use of conventional chemicals. "Such is the case in our extensive adjuvant portfolio that, despite not being a biological solution, helps farmers reduce chemical use by up to 15%," says a spokeswoman for the firm while speaking to Biologicals Latam. “Other examples are our microgranulated fertilizers that, despite using conventional nitrogen and MAP/DAP as raw material, achieve the same level of efficiency as conventional fertilizers but using only a quarter of the volume, avoiding water pollution and reducing CO2 emissions from the logistics side”.

The market has believed in the model. From the US$4.90 its share was worth at its initial public offering (IPO) in mid-March 2019, its latest values are at US$14.60. An increase of 200% in three years, although much of it took place in the first two. For Trucco, the firm's CEO, the overview is simple. “I want to say, bluntly, that we are on fire and delighted to be on fire,” he said at the conference. "Hopefully we can continue to deliver similar performances in the coming quarters."

Last issue articles

- Biome: the space gaining protagonism in biological strategies for crops

- The export dynamics driving the Mexican biologicals market

- New model developed to evaluate effects of two or more biostimulants combined in a single crop

- Dr. Wagner Bettiol and the biocontrol market in Brazil

- Las propiedades que hacen del Trichoderma un socio clave en la búsqueda de mejores desempeños en los cultivos

- Changes in the new regulation on fertilizers and biostimulants in Chile

- nnovak Global, la expansión de los especialistas en la raíz

Market movers

- Argentinean firm Puna Bio: Millions raised to study superbacteria for agricultural use

- Corteva Agriscience signed an agreement to acquire leading biologics company Symborg

- Brazilian study uncovers ants' potential in crop protection

- Huber acquires specialty plant nutrition producer Biolchim

- UPL announces agreement to distribute bioprotector based on orange oil

- ICL and Lavie Bio start strategic collaboration to develop new biostimulants

- Hortitool and Green Smile to organize the Morocco Berry Conference 2022

About us

Biologicals Latam es una revista digital de Redagrícola que informa de manera especializada sobre la intensa actividad que se está desarrollando en el espacio de los bioinsumos para la producción agrícola. Esta publicación es complemento del Curso Online de Bioestimulantes y Biocontrol y las conferencias que este grupo de medios realiza en torno al tema.